Offshore Accounting: What Is It and 5 Key Benefits

Written by NotaRadio on 21 Ιουνίου 2022

Onshore implies that your firm’s operations or assets and investments are conducted in your country. Going offshore, on the other hand, means that these activities take place in a different nation, region, or jurisdiction. You should hold several https://www.wave-accounting.net/ onboarding and training sessions for your offshore employees to get acquainted with your business’s methods and tools after they begin working for you. These talks are designed to raise their expertise to improve operational efficiency quickly.

What size company offshores accounting?

Offshore accounting services necessitate the use of skills that have been developed in dealing with large volumes of papers, bills, and books of accounts for your firm. You may save time by outsourcing accounting to them and having your documents correctly and on time for tax deadlines. Offshore accounting refers to assigning financial and accounting services to a firm or business process outsourcing (BPO) organization in a low-cost nation. Many accounting departments, especially since the pandemic, have been working remote and have become more aware of the challenges inherent in doing so. Any remote work requires tools to effectively communicate such as web meeting software, messaging and other tools.

Software Technologies

They may hire world-class talent at a quarter of the cost of hiring local talent. Outbooks will be your ideal choice in the USA if you are looking for a reliable accounting offshore. Contact seasoned professionals at Outbooks in the USA to learn more about our tailored solutions for your business needs. The accounting process might be slowed if they do not use the most up-to-date tools and technologies.

Business Solutions We Offer

Getting offshore accounting services helps companies lighten their workload and expand their businesses more easily. With this, the quality of their work also increases, which can increase their profit. We are The Offshore Accountants, a trusted partner for comprehensive accountancy services and offshore accounting solutions. With a strong reputation in the industry, we deliver exceptional financial management solutions to businesses and individuals across diverse industries.

Make sure that your offshored accounting staff should be able to follow strict deadlines. One of the main reasons why companies offshore in general, is to save up to 70% on costs. If your accounting tools and methods are not up-to-date, it can slow down your business progress. More so, you will definitely fall behind your competitors who are making use of the latest technologies and software. Your accounting plays a big and very important role in your business management. These days, it’s increasingly difficult to find the right talent, especially for hard to find positions such as Senior and Staff Accountants.

What Is Offshore Banking?

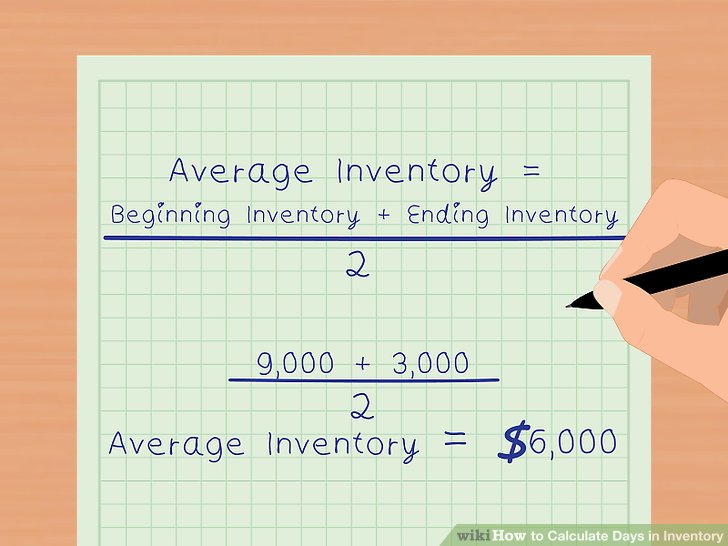

The benefits of outsourcing include access to specialized expertise, increased efficiency, improved accuracy, and greater control over finances. Offshore firms can provide a wide range of services, including general ledger, accounts payable/receivable, inventory management, stock maintenance and investment analysis. Businesses are increasingly recognizing the value of delegating accounting tasks to qualified service providers in other countries. “Outsourcing” is where a company hires another firm to perform a particular entire function or set of functions, such as accounts payable, accounts receivable or all accounting.

According to Indeed, the average cost for a Philippines-based offshore accountant is just over $1,000 USD per month. To get the best out of offshore accounting, I highly recommend implementing some of the strategies below. You can gain access to a broader range of candidates, offering benefits such as specialized expertise and increased adaptability to your firm’s work culture. And often, you’re competing with firms who can pay more than you can afford.

Once you’ve chosen which framework best suits your company, you’ll want to consider your budget, corporate goals, and the market landscape. It’s crucial to find an what is the capital gains tax on real estate in 2020 firm that offers good pricing, especially since it’s one of the most important reasons for outsourcing bookkeeping. By contrast, “offshore accounting” is where a company has a dedicated accounting team that that happens to be in another country that the company must manage. Every country has its own set of tax laws and reporting regulations that you must take into account before choosing an offshore service provider. Offshoring your tax reporting and filling also lets you submit your returns and declare taxes accurately on time.

Like any other staff, a remote staff too gets productive with time and inculcates the ability to do their work besides managing a few more people under them. Hence, hiring remote staff is a long-term solution and not a one-time or short-term adventure. Your investment in remote staff for the long term is a win-win situation for both the employer and the staff.

For business or real estate transactions, you may need to provide sales contracts or other relevant documents. If you deposit funds from an insurance contract, you may need to provide a letter from your insurance company. If https://www.personal-accounting.org/reporting-unearned-revenue/ your money comes from an inheritance, the bank may ask for a letter from the executor of the estate testifying to this effect. Regardless of what type of document you provide, banks will need to make sure it is authentic.

As a usual practice of working with remote staff, you can assign the task before leaving the office and check in the morning how the job has been performed overnight. One of the advantages of offshore accounting is the ability to scale your employees when needed. You might incur penalties and higher fees because of errors in your financial statements and payroll processing. Entrepreneurs like you might have the ability to handle several tasks at once, but it won’t be effective when you try bookkeeping and accounting. Your accounting partner should be able to provide customized services for you. You can also delegate bookkeeping to an offshore bookkeeping service so that your employees can concentrate on core business tasks that require their attention.

Offshore companies with skilled and trained employees will be able to manage accounting tasks efficiently — than unskilled employees. That’s why you must ensure that the outsourced accountant can carry out accounting swiftly and with perfection. Offshore accounting firms can take care of your financial statement preparations either periodically or yearly, based on your business needs. They are able to do so because they specialize in tax preparation and compliance. Safebooks Global firms specialize in providing a wide range of accounting services.

- Not just that, it also helps you determine the potential longevity of the particular staff in your firm.

- If you deposit funds from an insurance contract, you may need to provide a letter from your insurance company.

- Do a background check or read through their client reviews and past projects.

- In-house accounting services can often be overly expensive due to hiring and training costs and require too much management oversight.

Offshore accounting is one of the fastest growing techniques used by companies to achieve corporate goals of timely and reliable accounting processing. It allows companies to find the talent that is in such short supply at a significantly lower cost and be able to meet their timelines for accurate financial reporting. Finding excellent people in an unfamiliar culture might be difficult when you are thousands of miles away from your offshore team. The first significant challenge is finding an outstanding offshore service provider with expertise. You can be sure you fully comply with all applicable state, federal, and local regulations when you outsource your tax preparation and filing. Financial documents, purchases, accounting entries, and payroll will be compared and contrasted as part of this process.