Taxpayer identification numbers TIN Internal Revenue Service

Written by NotaRadio on 26 Νοεμβρίου 2021

WASHINGTON — The Internal Revenue Service today highlighted a number of options available to help taxpayers who missed the April deadline to file their 2023 federal income tax return. Visiting a designated IRS Taxpayer Assistance Center is one way to submit your application. Make sure you have your tax return and identification documents with you to avoid having to come back. The IRS is very particular when it comes to reviewing your ITIN Application, your U.S. tax return, and your proof of identity and foreign status. If you make any mistakes, your ITIN application will be rejected.

Social Security Number

Section 203 of the Protecting Americans from Tax Hikes Act, enacted on December 18, 2015, included provisions that affect the Individual Taxpayer Identification Number (ITIN) application process. Taxpayers and their representatives should review these changes, which are further explained in the ITIN Documentation Frequently Asked Questions, before requesting an ITIN. GovPlus® is a private online software technology company not affiliated nor endorsed by any Government or State agency. We do not charge for any forms, however, we charge for use of our software in assisting you with completing the form. We are not a financial, accounting or law firm and do not provide legal or financial advice.

Reminder when submitting documentation for ITINs

It is issued either by the Social Security Administration (SSA) or by the IRS. A Social Security number (SSN) is issued by the SSA whereas all other TINs are issued by the IRS. Alien taxpayers who need an Individual Taxpayer Identification Number (ITIN) may be able to secure one from outside the United States. Details can be found on the “Obtaining an ITIN from Abroad” page.

When and why were ITINs created?

You can also apply for an ITIN by completing a W-7 form and mailing it to the IRS. Within days, you will receive a confirmation letter in the mail letting you know the changes have been made. From that point forward, you will only be using your SSN and will no longer be allowed to use your ITIN.

Adoption Taxpayer Identification Number

- Apply for an ITIN in-person using the services of an IRS-authorized Certifying Acceptance Agent.

- At a minimum, you should complete Form W-7 when you are ready to file your federal income tax return by the return’s prescribed due date.

- The IRS has a long list of documents or combinations of documents that can show your status and identity.

- If you are not sure if you have a U.S. tax filing requirement, you will need to speak with an accountant for help.

- If this is your situation, don’t worry—there is a way to do so.

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The Tax Withholding Estimator helps individuals bring the tax they pay closer to what is owed. Though interest and late-payment penalties continue to accrue on any unpaid taxes after April 15, the failure to pay penalty is cut in half while an installment agreement https://www.adprun.net/ is in effect. Find more information about the costs of payment plans on the IRS’ Additional information on payment plans webpage. Information on filing tax returns using an ITIN is available for tax professionals. Although an ITIN/SSN mismatch is created when electronically filing tax returns reporting wages for ITIN holders, programming changes allow acceptance of these returns.

Preparer Tax Identification Number

The umbrella term “taxpayer identification number” (TIN) signifies all tracking numbers used by the IRS to organize tax filings by individuals and entities. The IRS has a long list of documents or combinations of documents that can show your status and identity. A current passport would meet all these requirements and is the only document you can submit on its own. An Employer Identification Number special educational provision (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Refer to Employer ID Numbers for more information.The following form is available only to employers located in Puerto Rico, Solicitud de Número de Identificación Patronal (EIN) SS-4PRPDF.

For more information see Allowable Tax Benefits in the Instructions for Form W-7PDF. https://www.business-accounting.net/vat-and-reverse-vat-calculator/ If you need an ITIN, find out how to get the state’s Excluded Workers Fund payments.

You will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete. You will only file a tax return to the address above once, when you file Form W-7 to get an ITIN. In subsequent years, when you have an ITIN, you will file your tax return as directed in the form instructions.

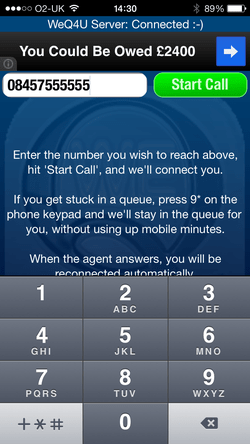

You will need to call ahead of time as an appointment is required. 1b.) If your legal name at birth was different than what you entered in #1a, then enter that here in #1b. We strongly recommend working with an accountant (specifically one that is listed as an IRS Acceptance Agent), since it is very easy to mess up Form W-7 and doing so will cause the IRS to reject your ITIN Application.

If you do not receive a letter from the IRS within those time frames, you can call them to check on the status of your ITIN Application. Another example of how hiring an accountant (that is an IRS Acceptance Agent) can help is regarding your passport. If you don’t certify your passport, you’ll need to send the IRS your original passport. That can be especially stressful if you need to travel soon or you’re currently traveling in the U.S. Instead, when hiring an accountant, they can certify your passport for you and send that in along with your ITIN Application (instead of using your original passport).

The IRS wants either your original passport or a certified copy of your passport. We recommend working with an accountant that is an IRS Acceptance Agent as they will be able to help you obtain a certified copy of your passport. Getting a certified copy of your passport is a lot better than sending in your original and having to wait multiple weeks before you get it back. If the ITIN applicant is a dependent, please see Form W-7 instructions for who can can sign here and how they should sign this section. 6c.) If you have a U.S. nonimmigrant visa, enter that information here. Please see the Form W-7 instructions for how to enter these details.

The accountants listed in the Acceptance Agent Program will also be able to help you apply for your ITIN. People who are ineligible for a Social Security number can apply for an Individual Tax Identification Number (ITIN), regardless of immigration status. With an ITIN, you can report your earnings to the Internal Revenue Service, open interest-bearing bank accounts with certain banks, and conduct business in the United States.

If you do not want to apply for a PTIN online, use Form W-12, IRS Paid Preparer Tax Identification Number Application. ITINs are not valid for identification outside the Federal tax system. For more information access the DMV communicationPDF provided to the state departments of motor vehicles. Terms and conditions, features, support, pricing, and service options subject to change without notice. This guide will take you through the steps of how to apply for ITINs, the average timeframe, and ways to streamline the process.