How to Reconcile in QuickBooks: Account Reconciliations in QuickBooks

Written by NotaRadio on 16 Μαρτίου 2021

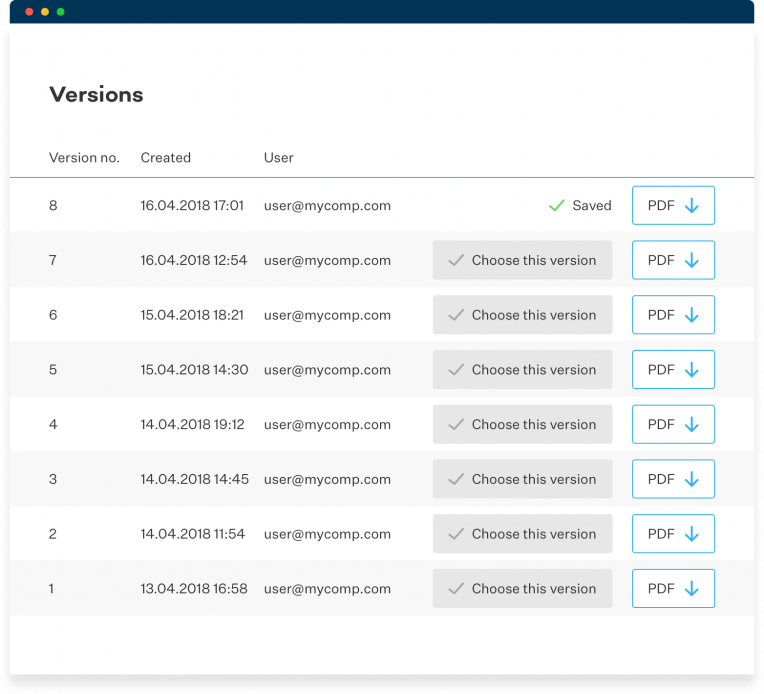

This allows them to undo the previous transaction without needing to manually edit individual transactions from within the register. If a reconciliation has too many discrepancies, reversing that reconciliation might be the best move. If you just need to start fresh from a previous reconciliation, you can get your accountant to reverse the current one. It will lessen the amount of manual reconciliation and unnecessary cross-checks.

Recording all transactions in QuickBooks Online

This validation step is pivotal in maintaining the integrity and accuracy of financial records, enabling businesses to confidently rely on their financial reports for decision-making and compliance purposes. Each step plays a significant role in ensuring the accuracy and integrity of your financial records. This process is crucial for maintaining accurate financial records and ensuring that there are no discrepancies in the company’s books. It entails reviewing each transaction, comparing it with the corresponding bank statement entry, and making any necessary adjustments to ensure the accuracy of the records. Whether you’re using QuickBooks Online or QuickBooks Desktop, understanding the process of reconciliation is crucial for ensuring the accuracy and integrity of your financial records.

Step 2: Start the reconciliation

This synchronization ensures accurate financial reporting and provides a reliable snapshot of your business’s financial health. Once you’ve reviewed and matched all transactions, QuickBooks will calculate the difference between your records and your bank or credit card is depreciation expense an operating expense statement. If the difference is not zero, you may need to review your transactions again to find any discrepancies. Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your bank and credit card statements.

How to Reconcile Bank Statement in QuickBooks Desktop?

The Zoho family of applications cover a plethora of business needs, and its steadily expanding customer base speaks to the quality of those products. Zoho Books is the accounting and finance portion of the platform, and it’s no slouch, even when compared to something like QuickBooks. Once you have a handle on day-to-day use of the QuickBooks Online accounting software, try adding a few more tips and tricks to help you get the most out of the experience.

- We also considered customer testimonials and ratings as vital components of our overall assessment of each software.

- If your sidebar menu is not what is shown in our tutorial, it means that you are on Business View.

- Once within the reconcile window, users can input the bank statement date, ending balance, and begin matching transactions.

- QuickBooks will display a message to confirm the reconciliation is complete and to ask if you want to make a payment towards this credit card balance.

- By finalizing the reconciliation process, businesses can have confidence in the reliability of their financial records and make informed decisions based on accurate data.

- Reconciliation is an accounting process used to ensure that two sets of records (usually the balances of two accounts) are in agreement.

How to Reconcile Balance Sheet Accounts in QuickBooks?

Troubleshooting reconciliation issues in QuickBooks demands a careful and methodical approach. By systematically addressing discrepancies, ensuring balance, and amending previously reconciled transactions correctly, the integrity of your financial records can be maintained. If you would like to streamline your reconciliation process in QuickBooks, Synder is the answer. Synder is a comprehensive financial management software that specializes in automating accounting processes for businesses, particularly those operating in ecommerce and using online payment platforms.

Sage 50 Accounting: Best for midsize businesses

It ensures that QuickBooks entries align with those in your bank and credit card account statements. You’ve just learned how to undo a bank reconciliation in QuickBooks Online by making corrections to the individual transactions that were reconciled. However, while it’s possible to unmark transactions included in the reconciliation and include the correct ones, we advise that you take proactive measures to ensure smooth reconciliation from the start. Ensure that all the details—including the dates, amounts, and descriptions—match your credit card statement. B. Click on Enter a bill to pay later to go to the Create Bill screen, where you can enter a bill for the balance you wish to pay by the due date shown on the credit card statement. Make sure the category is the credit card you just reconciled, the bill date is the statement date, and the due date agrees with the due date on the credit card statement.

If you reconciled a transaction by mistake, here’s how to unreconcile it. If you’re reconciling an account for the first time, review the opening balance. It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks.

If you’re a business owner or an accountant using QuickBooks Online to manage your company’s finances, it’s important to regularly reconcile your credit card accounts. Reconciliation ensures that the transactions in QuickBooks Online match those on your credit card statements, which helps maintain accurate financial https://www.personal-accounting.org/how-long-are-checks-good-for/ records. This process involves meticulously reviewing each transaction entry in QuickBooks and cross-referencing it with the corresponding entry in the bank statement. By performing this comparison, discrepancies such as missing transactions, duplicate entries, or incorrect amounts can be readily identified.

If necessary, make adjustments to the opening balance or opt to Undo Last Reconciliation to start anew. In your first reconciliation, ensure that the opening balance in QuickBooks Desktop is in sync with the balance of your real-life bank account as of your chosen start date. Reconciling your accounts is a critical accounting function in your business and one that should be completed regularly. Although it’s relatively easy to undo reconciliation in QuickBooks Online, doing so should be a rare exception rather than something you do as a regular part of your bookkeeping process. Reconciling your accounts is an important step in your business accounting process.

You may need to take into consideration when reconciling your accounts whether you’ve connected your bank accounts to the application or you’re just uploading your transactions electronically at month-end. Here are a few other things you may want to consider when using QuickBooks Online. Additionally, reconciliation provides businesses with a clear and up-to-date picture of their financial health. It allows you to analyze your cash flow, track expenses, and monitor income. This information is crucial for making informed business decisions, identifying potential risks or opportunities, and maintaining financial stability.

Another way to confirm the action is to click on the Reconcile button in the bank register. QuickBooks should allow you to reconcile the account and there should be no error message related to your beginning balance. You should enter a bill because doing https://www.quickbooks-payroll.org/ so moves a portion of your credit card liability to a current accounts payable (A/P). The advantage is that your credit card payment and due date now appear with your other A/P, so you have a reminder to pay the bill before it becomes overdue.

Over a short timeframe such as a month, differences between the two balances can exist (due to bank errors or checks that have not been cashed by the payee, for example). To fix the error, let’s unreconcile the $200 and $125 checks and mark the $325 check as reconciled. To unmark a reconciled transaction, click anywhere on the entry, click R until it’s blank, and then click the Save button, as shown below.

In the screenshot above, you’ll see that the checks for $200 and $125 are already reconciled though they haven’t been cleared by the bank. Similarly, the $325 is not yet reconciled, where in reality, it has already cleared. To do this, right-click on the reconciliation screen’s tab in your internet browser and select “duplicate” to open a second tab. Once the changes are saved, you’ll need to refresh the original tab to see the updated screen. You need to investigate any transaction in QuickBooks that isn’t on your bank statement. While the most likely cause is an error in your QuickBooks accounting, don’t delete the transaction because it may affect other accounts or periods.

This will let you quickly reference the report as you’re working to undo the reconciliation. Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. Once you’re done, you should see a difference of $0, which means your books are balanced. Let me help you regarding your deleted reconciled entries inside QuickBooks Online (QBO).