1 Stock to Buy With Ambitions of Becoming the Leading Artificial Intelligence AI Company in the World The Motley Fool

Written by NotaRadio on 5 Νοεμβρίου 2021

AI’s novel applications strain existing legal frameworks, often leading to delays in consensus building around new rules, the discussants noted. This lag results in potential compliance and operational risks, especially for novel financial products and services. Furthermore, the natural risk aversion of regulatory bodies contrasts with the private sector’s agility, necessitating a more nuanced approach examples of manufacturing overhead in cost accounting to fostering innovation while mitigating risks, they added. The panelists noted that AI ventures are attracting substantial investments, including collaborations with startups and strategic academic partnerships. Also, financial institutions are leveraging AI to analyze vast trade volumes, providing actionable insights into trade probabilities and enhancing market participation strategies, they said.

2.3. Credit intermediation and assessment of creditworthiness

Traders may intentionally add to the general lack of transparency and explainability in proprietary ML models so as to retain their competitive edge. In addition, the use of algorithms in trading can also make collusive outcomes easier to sustain and more likely to be observed in digital markets (OECD, 2017[16]). AI-driven systems may exacerbate illegal practices aiming to manipulate the markets, such as ‘spoofing’6, by making it more difficult for supervisors to identify such practices if collusion among machines is in place.

Improve decision-making

Underwrite.ai uses AI models to analyze thousands of financial attributes from credit bureau sources to assess credit risk for consumer and small business loan applicants. The platform acquires portfolio data and applies machine learning to find patterns and determine the outcome of applications. Scienaptic AI provides several financial-based services, including a credit underwriting https://www.quickbooks-payroll.org/ platform that gives banks and credit institutions more transparency while cutting losses. Its underwriting platform uses non-tradeline data, adaptive AI models and records that are refreshed every three months to create predictive intelligence for credit decisions. AI is transforming the financial forecasting and planning process through predictive analytics.

Document Processing

At the current stage of maturity of AI solutions, and to ensure that vulnerabilities and risks arising from the use of AI-driven techniques are minimised, some level of human supervision of AI-techniques is still necessary. The identification of converging points, where human and AI are integrated, will be critical for the practical implementation of such a combined ‘man and machine’ approach (‘human in the loop’). Skills and technical expertise becomes increasingly important for regulators and supervisors who need to keep pace with the technology and enhance the skills necessary to effectively https://www.business-accounting.net/what-are-the-required-financial-statements-under/ supervise AI-based applications in finance. Enforcement authorities need to be technically capable of inspecting AI-based systems and empowered to intervene when required (European Commission, 2020[43]). The upskilling of policy makers will also allow them to expand their own use of AI in RegTech and SupTech, an important area of application of innovation in the official sector (see Chapter 5). Solid governance arrangements and clear accountability mechanisms are indispensable, particularly as AI models are increasingly deployed in high-value decision-making use-cases (e.g. credit allocation).

What is more, the deployment of AI by traders could amplify the interconnectedness of financial markets and institutions in unexpected ways, potentially increasing correlations and dependencies of previously unrelated variables (FSB, 2017[11]). The scaling up of the use of algorithms that generate uncorrelated profits or returns may generate correlation in unrelated variables if their use reaches a sufficiently important scale. It can also amplify network effects, such as unexpected changes in the scale and direction of market moves. A number of defences are available to traders wishing to mitigate some of the unintended consequences of AI-driven algorithmic trading, such as automated control mechanisms, referred to as ‘kill switches’. These mechanisms are the ultimate line of defence of traders, and instantly switch off the model and replace technology with human handling when the algorithm goes beyond the risk system and do not behave in accordance with the intended purpose.

- Larger players are also using AI to fight fraud, a problem which cost the UK £1.2bn in 2022 according to industry trade body UK Finance, including Mastercard.

- AI can then use the data to help generate financial statements, such as income statements, balance sheets, and cash flow statements, transforming the data into reports that highlight key performance indicators (KPIs), trends, and observations.

- Additionally, the ability to handle vast amounts of data quickly and accurately helps firms make swift, informed decisions, crucial for maintaining competitiveness in the fast-paced financial sector.

- Lastly, AI-powered chatbots and digital assistants strengthen relationships with customers by answering questions on demand and providing fast, around-the-clock service.

- “At 23 times 2024 expected earnings, the market-cap weighted S&P 500 is froth with excess and, in my judgment, uninvestable.”

Merging AI models, criticised for their opaque and ‘black box’ nature, with blockchain technologies, known for their transparency, sounds counter-intuitive in the first instance. The use of AI and big data has the potential to promote greater financial inclusion by enabling the extension of credit to unbanked parts of the population or to underbanked clients, such as near-prime customers or SMEs. This is particularly important for those SMEs that are viable but unable to provide historical performance data or pledge tangible collateral and who have historically faced financing gaps in some economies. Ultimately, the use of AI could support the growth of the real economy by alleviating financing constraints to SMEs. Nevertheless, it should be noted that AI-based credit scoring models remain untested over longer credit cycles or in case of a market downturn. Given the investment required by firms for the deployment of AI strategies, there is potential risk of concentration in a small number of large financial services firms, as bigger and more powerful players may outpace some of their smaller rivals (Financial Times, 2020[6]).

With a complete, cloud ERP system that has AI capabilities built-in, finance teams can get the data they need to help increase forecasting accuracy, shorten reporting cycles, simplify decision-making, and better manage risk and compliance. With Oracle’s extensive portfolio of AI capabilities embedded into Oracle Cloud ERP, finance teams can move from reactive to strategic with more automation opportunities, better insights, and continuous cash forecasting capabilities. Credit scoring powered by machine learning has proven invaluable for the finance industry, enabling rapid and accurate assessments with reduced bias. The key is using AI to assess potential borrowers based on alternative data such as rent payment history, job function, and financial behavior. Not only does this result in more accurate risk analysis by considering important indicators, but it also enables potential borrowers without a credit history to be assessed. JP Morgan utilizes AI for risk management, fraud detection, investment predictions, and optimizing trading strategies by analyzing vast amounts of financial data.

A particularly valuable technology in regulatory compliance is natural language processing (NLP). NLP is capable of quickly parsing through large amounts of textual data, transforming raw text or speech into meaningful insights. It can analyze lengthy documents, contracts, policies, and other text sources to extract critical information, pertinent changes, and potential compliance risks. NLP can even facilitate document management, automatically classifying documents based on predetermined criteria.

The software allows business, organizations and individuals to increase speed and accuracy when analyzing financial documents. Ocrolus’ software analyzes bank statements, pay stubs, tax documents, mortgage forms, invoices and more to determine loan eligibility, with areas of focus including mortgage lending, business lending, consumer lending, credit scoring and KYC. AI has already brought significant changes to the finance function, and its impact is expected to keep growing. As AI technologies—and the skills of those who use them—advance, they will become more deeply embedded in the function.

The proposal also provides for solutions addressing self-preferencing, parity and ranking requirements to ensure no favourable treatment to the services offered by the Gatekeeper itself against those of third parties. Strategies based on deep neural networks can provide the best order placement and execution style that can minimise market impact (JPMorgan, 2019[8]). Deep neural networks mimic the human brain through a set of algorithms designed to recognise patterns, and are less dependent on human intervention to function and learn (IBM, 2020[9]). Traders can execute large orders with minimum market impact by optimising size, duration and order size of trades in a dynamic manner based on market conditions.

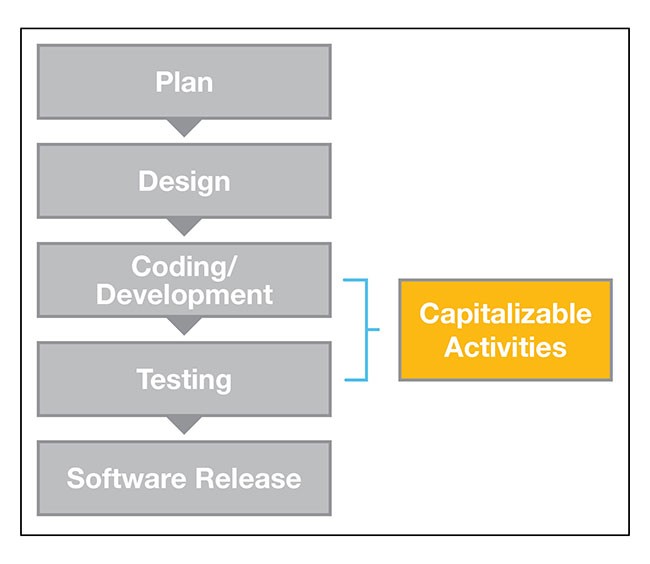

For many IT departments, ERP systems have often meant large, costly, and time-consuming deployments that might require significant hardware or infrastructure investments. The advent of cloud computing and software-as-a-service (SaaS) deployments are at the forefront of a change in the way businesses think about ERP. Moving ERP to the cloud allows businesses to simplify their technology requirements, have constant access to innovation, and see a faster return on their investment. Specific software, such as enterprise resource planning (ERP,) is used by organizations to help them manage their accounting, procurement processes, projects, and more throughout the enterprise.